Thursday 19 December 2013

Specialist Loss Assessors

Seeing the effects of a fire at your home is one of the most traumatic events you are ever likely to encounter. Unless a professionally prepared evaluation of the insured damage is made it could cost you thousands of pounds. Speak to our team of specialist loss assessors today, to get you the best possible settlement. For more information please visit us at - http://www.assistedclaims.co.uk

Thursday 12 December 2013

Burst Pipe and Water Damage Insurance

With winter weather becoming more and more erratic you need to make sure, should

your home get flooded, you know who to call

regarding a water damage claim. Using a reputable loss assessor like us can help you get

accurate compensation. Remember, we are working for you, not the insurance

company. Serious water damage can be even more devastating to a house that fire

unless treated correctly. For more

information, please visit - http://www.assistedclaims.co.uk/burst-pipe-water-damage-insurance-claim

Thursday 5 December 2013

Candles are Special… So take Special Care

Candles are a very popular thing which a lot of people use to create nice and welcoming atmospheres, for example they are used a lot for birthdays, special occasions or to just relax. However a candle with a naked flame can be very dangerous and cause a fire, especially in a home, so you need to take extra care when using candles. Assisted Claims can help you with a fire damage claim, read more of this article at: http://www.assistedclaims.co.uk/candles-are-special

Thursday 28 November 2013

Accident

Have

you recently had an accident or need to deal with a crisis, at work

or at home? Or would you simply like to know about your options if a

crisis did occur? The last thing you want is extra expenses and

hassle in these situations, which is why it’s important to realise

the differences in services that are available. For more information

about the services that we offer please visit us at -

http://www.assistedclaims.co.uk

Friday 22 November 2013

Latest news- Firefighters Issue Tea Light Warning Following Bedroom Blaze

As Loss Assessors, we are all too aware

of the risks of harmless things like tea lights as fire hazards. A woman from

Crawley had a lucky escape after a tea light sparked a fire in her bedroom. The

emergency services arrived just after 10pm after the tea light had burned

through the shelf it was on and had set alight to the ladies’ bedding. Luckily

there was no harm to anyone in the property however it could have easily

happened. To view the full story visit our website - http://www.assistedclaims.co.uk/news

Friday 15 November 2013

Professional Loss Assessors with years of experience

We are a secure firm of professional

Insurance Loss Assessors with many years of experience, who will act on your

behalf if you need to make an insurance claim. One of our recent stories is of

a woman who had a lucky escape after a tea light sparked a fire in herbedroom. The crews arrived on scene within minutes and

firefighters were wearing breathing apparatus so that they could quickly

extinguish the blaze using a hose reel.

The lady was then taken to the hospital

for a counteractive check but was then released shortly afterwards. One of the

most traumatic events is seeing what the effects of a fire can cause to your

house, so if you need to make a claim to save you thousands of pounds then call

us on 0845 686 0845.

Friday 8 November 2013

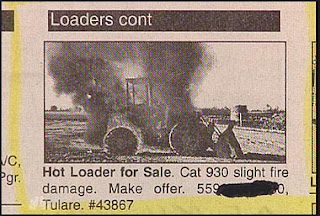

Slight fire damage

Having

trouble assessing the damage after a fire, maybe this seller should have

contacted us!

If

you would like help after a fire, flood or burglary please visit our website

for more information: http://www.assistedclaims.co.uk/

Friday 1 November 2013

Lakanal House Fire: 'No fire risk assessment' done of tower

No

valid fire risk assessment was in place when a fire broke out in a south-east

London tower block claiming six lives in 2009, an inquest has heard.

New

rules from 2006 meant all councils were required to carry out fire risk

assessments on their properties.

Chartered

surveyor David Walker, an expert witness, said Southwark Council "should

have prioritised" Lakanal House in Camberwell, as it was

"high-risk".

Six

people, including three children, were killed in the fire in July 2009.

Catherine

Hickman, 31, Dayana Francisquini, 26, and her children, six-year-old Thais, and

Felipe, three, were killed in the fire.

Helen

Udoaka, 34, and her three-week-old daughter Michelle also died.

'High-risk building'

Lakanal

House was a "high-risk building", Mr Walker said, but no valid fire

risk assessment was in place when the fire broke out.

Giving

evidence he said when the new regulations came into effect in 2006 few local

authorities prepared for their new responsibilities.

Refurbishments

took place at Lakanal House in 2006, but no risk assessment was done at the

time.

Mr

Walker said: "In my opinion London borough of Southwark should have

carried out a fire risk assessment of Lakanal House.

"It

was a high-risk building which should have been prioritised in any risk

assessment programme."

As

a result of no assessment being done serious fire hazards were probably

overlooked, he added.

The

suspended ceiling was high-risk and needed immediate attention before the fatal

fire as it breached safety designs around compartmentation, Mr Walker told the

inquest.

The

fatal tower block fire triggered a dramatic increase in completion of fire risk

assessments, but questions have been raised about how credible those

assessments were, the coroner heard.

Mr

Walker said: "Fire risk assessments are still of variable quality... a

complex building needs a fire risk assessor with comprehensive training and

experience to do credible assessments."

The

inquest continues.

For information on the products

and services we offer at Firesafe please visit us online- www.firesafeinternational.co.uk

Loss assessors assist in house fire drama

Loss assessors from Assisted Claims came to the rescue when Mrs J returned from a well earned holiday with her daughter only to discover that her daughters jilted boyfriend had attempted to burn down their house. He had let himself in through the back door and set a fire of the daughters possessions in her bedroom before escaping the blaze. There were many difficult questions to be answered before insurers would accept liabilty for the damage and Mrs J and her daughter were relieved to have engaged the loss assessing services of Loss Assessor Assisted Claims to guide them through the minefield of questions.

The ex-boyfriend was jailed and with the help of our qualified Loss Assessor, Mrs J’s Insurers eventually accepted the claim in full and the final settlement figure was in excess of £100,000

Assisted Claims are a firm of professional loss assessors with many years of experience in all types of insurance claims. They are authorized and regulated by the Financial Services Authority and adhere to a strict code of practice. If you need to make an insurance claim or you are unhappy with the settlement you have been offered by your insurer, simply call and speak to one of our qualified Loss Assessors on 0845 686 0845 for a free consultation. We work on a no-win, no fee basis.

For information on the products and services we offer at Assisted Claims please visit us online- http://www.assistedclaims.co.uk

Thursday 24 October 2013

What is a loss assessor?

Have you ever wondered what a loss assessor is and what they do? Loss assessors, like ourselves work on behalf of insurance claimants and it is our job to make sure that they get the very best cash settlement possible. However, you must have a current insurance policy in order to use a professional loss assessor. Most loss assessors like us, work for the claimant alone and this is generally on a no win, no fee basis – making us work even harder to succeed.

Continue reading at - http://www.assistedclaims.co.uk/what-is-a-loss-assessor-3

Continue reading at - http://www.assistedclaims.co.uk/what-is-a-loss-assessor-3

Friday 18 October 2013

Insurance loss assessor

The primary role of a loss assessor in

an insurance claim is to maximize the claim by negotiating with insurers to

achieve the best deal in the shortest time. By representing and guiding you

through the process of making an insurance claim our professional insurance

loss assessors aim to achieve the maximum settlement. For further information

or to make a claim, talk to one of our insurance assessors today on 0845 686

0845 or visit us online at http://www.assistedclaims.co.uk

Monday 14 October 2013

Loss assessors

The primary role of a loss assessor is

to maximize the claim so that the insured parties don't go without. A loss assessor is also

responsible for dealing with the insurance company so that a deal can be sorted

quickly and efficiently, this means that all of our loss assessors have plenty

of experience in dealing with a

vast range of claims. To find out more visit us

at http://www.assistedclaims.co.uk/loss-assessors-role-in-an-insurance-claim

Wednesday 9 October 2013

Our Service

As loss assessors, at Assisted Claims

we will represent your best interests alone and work to achieve the best

possible settlement on your behalf. Without professional help, the small print

in your policy may work against you.

Remember, loss adjusters work for and

are paid for by your insurance company. They are not paid to help you claim! A

loss adjuster is appointed to minimize the financial exposure of your insurance

company. Find out more about the service our team of specialist loss assessors’ offer by visiting our website.

Wednesday 2 October 2013

Loss Assessors

If you are the victim of a burglary or

theft then we may be able to help as specialist loss assessors. We go beyond

the service of your insurance company or loss adjuster to deliver a

comprehensive insight about what options are available to you based on your

circumstance. Find out more at our website.

Wednesday 25 September 2013

Loss Assessors

Acrid smoke from a domestic fire

usually contains high levels of acids which unless they are dealt with quickly

will speed up the deterioration process. Unless a professionally prepared

evaluation of the insured damage in a timely manner, it could cost you

thousands of pounds. Find out more about the service our team of specialist

loss assessors offer by visiting our website.

Wednesday 18 September 2013

Loss Assessor

Have you ever wondered what a loss assessor is and what they do? Loss assessors, like ourselves work on behalf of insurance claimants and it is our job to make sure that they get the very best cash settlement possible. However, you must have a current insurance policy in order to use a professional loss assessor. Most loss assessors like us, work for the claimant alone and this is generally on a no win, no fee basis – making us work even harder to succeed. Read more - http://www.assistedclaims.co.uk/what-is-a-loss-assessor-3

Monday 9 September 2013

Professional Loss Assessors and Insurance Assessors

As professional loss assessors and insurance assessors, we will represent your very best interests alone and we will work to achieve the best settlement on your behalf. We have experience in dealing with burglary claims, water damage insurance claims, fire damage claims and more. Without professional help from insurance assessors like us, the small print in your policy may work against you. Find out more by visiting us online at - http://www.assistedclaims.co.uk/

Tuesday 3 September 2013

Loss Assessors - Burst Pipe & Water Damage Insurance

The past few winters have been

exceptionally harsh and unprecedented amounts of snow has on occasions brought

the country to a standstill. Burst pipes are a common consequence and the

effects are sometimes devastating. If you are unfortunate enough to be

subjected to something like this. Beware. Many insurers have exclusions in

their small print that don’t protect you unless you have complied with policy

conditions.

Assisted Claims can help you make as successful insurance claim with your insurance

provider. We are independent team of loss assessors that will be working for

you, not your insurance company. Extensive water damage can even be more

invasive than a fire. Unless the correct drying procedures are implemented the

effects can go un-noticed and the end results can be devastating. To find out

more about our service as loss assessors please visit our website or call us on

0845 686 0845.

Tuesday 27 August 2013

Loss Assessors - Impact Damage Insurance Claim

Damage

caused due to sudden impact is a more common occurrence than you may

think. Whether it be from a vehicle, errant plant, machinery, a

falling tree or anything else the consequences, whether to a domestic

property or a commercial premises, can be dramatic and sometimes

calamitous.

At

Assisted Claims, our loss assessors have extensive experience in

dealing with this type of claim. To find

out more please visit our website

or give us a call on 0845

686 0845.

Tuesday 20 August 2013

Loss Assessors Role In An Insurance Claim

The main role of a loss assessor,

like ourselves in an insurance claim is to maximize the claim to ensure that

the policy holder or the claimant gets the best settlement available from their

insurance provider. We will use all of our knowledge and experience to

negotiate with insurers so that we can achieve the best deal in the shortest

time to suit you. Find out more by visiting our website.

Tuesday 13 August 2013

Loss Assessors – Impact Damage Insurance

Damage caused as a result of sudden

impact is a more common occurrence than you may think. Whether it be from a

vehicle, errant plant or machinery, a falling tree or anything else, the

consequences whether to a domestic property or a commercial premises, can be

dramatic and consequential.

Our loss assessors have extensive

experience in dealing with this type of claim. Safety and security are

paramount in these circumstances and we have the resources to call upon to

ensure the impacted property is made safe. Our network of professionals include

engineers, surveyors and specialist contractors who can assist in the

preparation of comprehensive schedule of works to ensure the property is

returned to its pre-loss condition. If you would like to find out more about

all our services as professional loss assessors, then please visit our website or call us on 0845

686 0845.

Tuesday 6 August 2013

Loss Assessors – Flood & Storm Damage Insurance Claim

Have you been a victim of the latest

floods to sweep the country? If so Assisted Claims can help you make as

successful insurance claim with your insurance provider. We are independent

team of loss assessors that will be working for you, not your insurance company.

Extensive water damage can be more invasive than a fire, unless the correct

drying procedures are implemented the effects can go un-noticed and the end

results may be devastating. If you would like to find out more then please

visit our website.

Friday 26 July 2013

Loss Assessors – Smoke Damage Insurance Claims

If

you ever had a fire in your home or business then it would most

probably be a traumatic event that causes a lot of damage. However,

it is often the affect of the smoke that causes more damage. At

Assisted Claims we are an experienced team of loss assessors and

insurance assessors who can deal with smoke damage insurance claims,

fire damage insurance claims and much more. Visit our website for

further information.

Friday 19 July 2013

Chinese Lantern Causes Christening Fire

We

were recently called to help a homeowner who had inadvertently set

his house on fire whilst celebrating his sons christening! The

christening celebrations of baby Jenson culminated in the lighting

and launching of some twenty or so Chinese lanterns. While most of

the lanterns rose majestically into the night sky burning themselves

out in the process, one errant lantern landed on the plastic roof of

an unattended conservatory at the side of the house and caused a

serious fire bringing the celebrations to an abrupt end! -

http://www.assistedclaims.co.uk/fire-damage-insurance-claims-chinese-lantern-causes-christening-fire

Monday 15 July 2013

Insurance Assessors

Here

at Assisted Claims we are an experienced team of professional insurance assessors who will represent your best

interests and work to achieve the best settlement to suit you. We are

experienced in dealing with fire and smoke damage claims, impact damage claims,

flood damage claims, burglary claims and much more. If you would like further

information on how our insurance assessors can help you, visit us online.

Monday 8 July 2013

Professional Loss Assessors

Here

at Assisted Claims we are an experienced team of professional loss

assessors who will represent your best interests and work to achieve

the best settlement to suit you. We are experienced in dealing with

fire damage claims, impact damage claims, flood damage claims,

burglary claims and much more. If you would like further information

on how our loss assessors

can help you, visit us online.

Friday 28 June 2013

Loss Assessors - Learn Not to Burn

Fires are set for different reasons. From natural curiosity to criminal acts. The school summer holidays see a significant rise in the number of cases of arson and East Sussex Fire And Rescue Service have launched a campaign to highlight the dangers of children playing with fire and list the of tell tale signs to look out for if a child is playing around with fire. Read more - http://www.assistedclaims.co.uk/loss-assessors-learn-not-to-burn

Friday 21 June 2013

Loss assessors assist in house fire drama

Loss

assessors from Assisted Claims came to the rescue when Mrs J returned

from a well earned holiday with her daughter only to discover that

her daughters jilted boyfriend had attempted to burn down their

house. He had let himself in through the back door and set a fire of

the daughters possessions in her bedroom before escaping the blaze.

Read more of our article by visiting -

http://www.assistedclaims.co.uk/loss-assessors-help-in-house-fire-drama

Friday 14 June 2013

Friday 7 June 2013

Friday 31 May 2013

When A Home Owner Discovers Cracks in His Property it is a Cause for Great Concern

It

is a cause for great concern when a home owner discovers a crack in

his most valuable asset , the family home. The issue of subsidence

has only come to the fore in the past 40 years, before which, it was

not normally covered on a standard household policy. That’s not to

say it didn’t happen but seasonal movement rarely resulted in

structural instability and cracks opened and closed and filling and

redecoration were seen as part of a regular maintenance programme.

Read more at -

http://www.assistedclaims.co.uk/loss-assessors-subsidence-claims

At

Assisted Claims our team of professional loss assessors are

experienced in dealing with a range of insurance claims. Find out

more by visiting us online.

Thursday 23 May 2013

Take a look at our latest YouTube video on Fire Damage Insurance Claims - http://www.youtube.com/watch?v=1GaP92Xw8Vc

Friday 17 May 2013

Friday 10 May 2013

Loss Assessors - Flood and Storm Damage Insurance Claims

If you would like more information on flood and storm damage insurance claims then contact one of our qualified loss assessors today on 0845 686 0845.

Friday 3 May 2013

Loss Assessors

Here

at Assisted Claims, we are a firm of professional insurance loss

assessors and we have a wealth of experience within the industry. If

you need to make an insurance claim, then we will act on your behalf.

The popular insurance claims that we get include fire damage claims,

smoke damage claims, flood damage claims and more. If you would like

more information on our services, contact one of our loss assessors today on 0845 686 0845

Subscribe to:

Posts (Atom)